For more than a half a century, Home Innovation Research Labs has worked hand-in-hand with builders and suppliers to bring beneficial innovation to home construction. In recent years, with chronic undersupply of skilled construction labor, offsite construction methods have regained renewed interest. Over the past few years, Home Innovation has conducted numerous studies to track the adoption of offsite technologies, identify and remove specific barriers, and create solutions that enable the industry to make the shift.

In 2020, Home Innovation began a comprehensive assessment of barriers home builders faced in adopting specific offsite construction practices. We surveyed a nationwide sample of 300 homebuilders and asked them to describe in their own words what’s keeping them from adopting offsite construction (modular, panelization, etc.). Their feedback was evaluated, then systematically categorized into a comprehensive set of reasons for not adopting offsite construction methods. In the following year, these were presented to 348 builders, who were asked to pick their top three. Not surprisingly, their top answer was that site-building worked fine and they saw no need to change. The findings of this research phase presented in a blog in 2021.

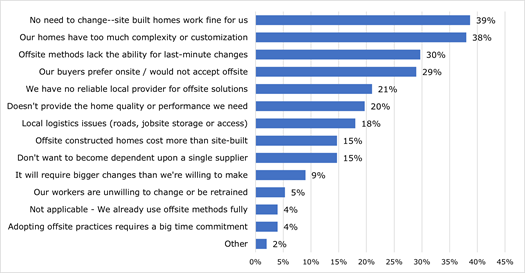

In September 2023, changing market conditions prompted Home Innovation to field the identical question in a new builder survey to assess how builders’ attitudes towards offsite construction had shifted. Two new answer categories were added addressing home design complexity and quality/performance expectations. The overall findings are summarized below:

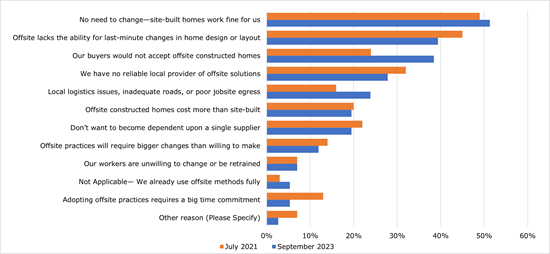

The graph below compares the findings from the 2021 and 2023 “barriers to offsite” survey questions. (The totals for the 2023 survey were normalized due to the addition of the 2 response categories so the results are properly comparable). Because the respondent profiles were very similar, we can conclude that large differences between the two years indicate directionality of a trend. For example, two barriers rose substantially in the ranking during the 2 year period: home buyers not accepting offsite rose from the #4 position to #3. This can be readily explained that the rising interest rates over the past 2 years have put many lower-end buyers out of the market, who are typically younger and have less bias against offsite-constructed homes. This should resolve as entry-level buyers return to the market when interest rates decline. Rising from 7th position to 5th was local logistics issues.

There were also a few that fell in the rankings during the past 2 years: the barrier of adopting offsite as a major time commitment fell from the 11th place to 9th place —understandably because many builders’ production volume has declined over the past 2 years and allowed them to adopt construction practices they have previously avoided.

Looking back at how builders responded to innovation in the wake of the housing bust of the Great Recession, there was an observable uptick in the use of newer building materials such as cold-formed steel framing and insulating concrete forms. With housing production issues no longer as pressing, builders seemed to invest in making improvements to their homes and businesses. Further, evidence suggests that builders changed construction practices out of competitive necessity—the much smaller remaining market for new homes was much more scrutinizing, and builders adopted strategies to set their homes apart from those of other builders.

Traditional thinking in “diffusion of innovation” research has emphasized the removing of barriers as the key strategy for the market acceptance of a beneficial technology. My practical experience as a marketing researcher in construction over the past 30 years indicates that many new technologies successfully becoming “mainstream” can only be partially ascribed to the removal or overcoming of barriers. In the coming weeks, we will be publishing the findings from a survey of builders that address whether there are any specific “enablers” or “facilitators” that can play a role in convincing builders to adopt offsite construction. In the meantime, if you’d like to discuss developing a market expansion strategy for a specific construction technology, feel free to contact me and we’ll get that discussion started.

***