Earlier this spring, I was asked to be a guest speaker at the Pressure Sensitive Tape Council’s Tape Week conference in Buena Vista, Fla. I provided the audience with an in-depth review of six key market opportunities for pressure-sensitive tapes and adhesives in residential construction, referencing our most recent Builder and Consumer Practices data trends and key drivers and market volumes for the six product categories. Below is a brief recap of the presentation takeaways:

Resilient flooring—Luxury vinyl has revitalized the resilient flooring segment, and “peel-and-stick” is regaining popularity, even finding its way into the luxury vinyl category. Opportunities are particularly in home remodeling.

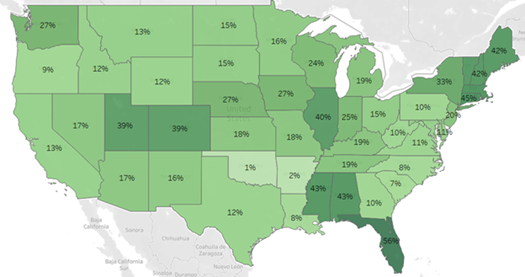

Roofing underlayment—Increased attention on resiliency in construction is making the “sealed roof deck” a more popular option, particularly in high-wind areas and those with heavy snow loads. Residential re-roofing remains the biggest market opportunity.

Shares of Self-Adhered Roofing Underlayment

in New Home Construction, 2020

Source: Home Innovation Research Labs’

2020 Builder Practices Report on Roofing Underlayment

Self-adhered housewrap—Long-popular in non-residential building, self-adhered housewraps are getting particular attention among high-end and high-performance home builders.

Roof sheathing seam tape—Another option for a sealed roof decks that is especially relevant for more modestly-priced homes and where a fully-adhered roofing underlayment does not fit the construction budget.

Wall sheathing seam tape—Another option for sealing external walls against air and water infiltration, seam tape is getting more popular, particularly with combination OSB sheathing and WRB panels, which now represents 10% of the exterior wall sheathing market in new homes, and with foam board insulating sheathing, now found on nearly 30% of all new homes.

Flashing tapes for windows and doors—While not a new opportunity, this category has the potential for high volume with many opportunities for value-added, and potentially higher-margin, flashing tapes.

This presentation touches on several of the 50 product categories covered in our Annual Builder and Consumer Practices Reports. 2022 Consumer Practices Reports are now available, and 2022 Builder Practices Reports will be shortly.

Don’t get stuck thinking about your market opportunities with outdated information. Contact me directly to learn how you can gain access to the 2022 data and stay abreast of the construction product markets.