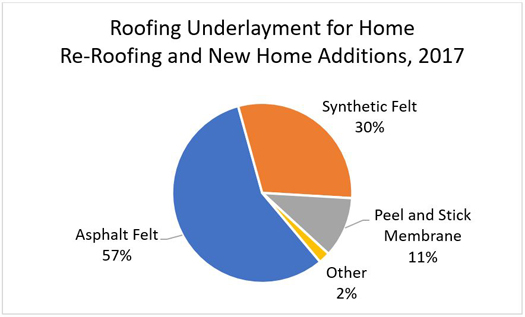

This year, for the first time, Home Innovation’s Consumer Practices Survey contained questions on roofing underlayment for re-roofing and installation on new additions and detached buildings. Here’s a sneak peek at the results...

Source: Home Innovation Research Labs Annual Consumer Practices Survey

The home re-roofing market is massive — about 16 billion square feet of existing residential roof was re-covered last year – and the majority of re-covers get at least one layer of roofing underlayment. An additional 3 billion square feet of new roofing underlayment was installed on new U.S. homes in 2017. As a roofing material, asphalt shingles have been dominant for decades, and there’s very little threatening that lead position. However, underneath those shingles and other roofing materials, there is a lot of change underway.

According to the most recent survey, and confirming our previous suspicions, traditional asphalt felt is still the most popular underlayment. Synthetics and peel-and-stick options, however, are making big inroads; this study underscored just how big. In recent years, contractors have told us they like the light weight, strength, and improved walkability of synthetics. In addition, they like that they can use them for a longer-term dry-in when they don’t want to (or can’t) get the roofing installed immediately. Loyal fans of asphalt felt believe it has stood the test of time, and don’t see much benefit in underlayment with added weather resistance if they shingle-over the underlayment the same day. On a per-square-foot basis, mid- and high-end synthetics cost more than asphalt felt, but lower-cost synthetics have become cost-competitive with asphalt felt. Self-adhered underlayment is code-required in many locations and applications but, believing it has superior leak resistance, some contractors use it even when and where it’s not required.

To gauge the current state of the roofing underlayment market, Home Innovation added new questions to both our Builder and Consumer Practices Survey questionnaires. Some additional findings generated by these questions include:

By June of this year, with the Builder Practices Survey results compiled, we’ll be able to characterize the entire residential market for roofing underlayment by volume installed, and by national, state, metro, and county-level geographic areas.

I’d love to tell you more about this new report series – contact us for details.