Ed Hudson, MBA

May 10, 2019

Hot, Fresh Data Now Available: 2019 Annual Builder Practices Reports

Data collection for our Annual Builder Practices Survey is complete and initial findings are now being published. More than 1,500 U.S. home builders participated this year to give us highly detailed information on their new home characteristics and the products they purchased for their homes.

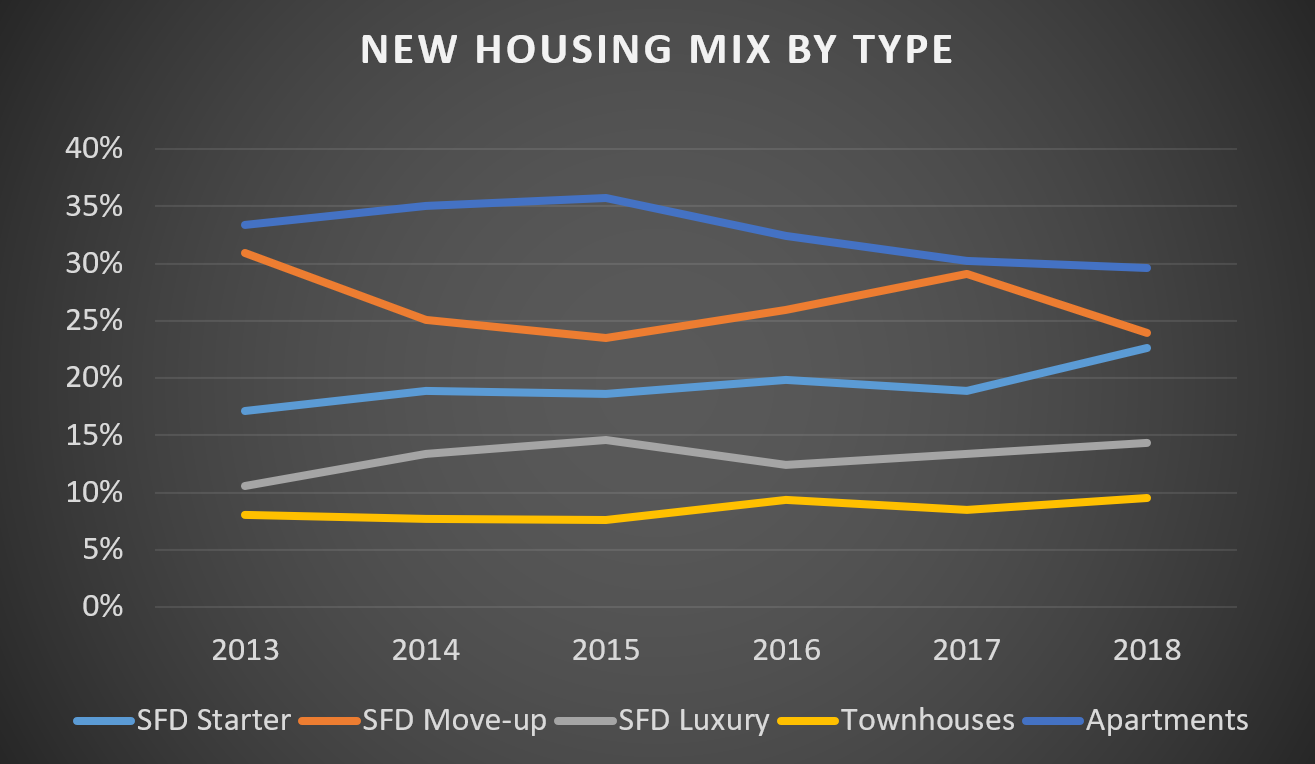

The Builder Practices Survey tracks many different new home product purchases and general housing characteristics. This year’s study shows a continued evolution in our new housing mix with Apartments still on top but declining as a percent of all U.S. housing starts. The biggest upswing is in Single-Family Detached (SFD) Starter homes, and the biggest drop was in SFD Move-up homes. These changes have a major impact on both volume and type of materials that go into a new home.

Source: Home Innovation's Annual Builder Practices Survey

Here are some other highlights from this year’s study:

- Windows—Vinyl is still the most popular window frame material, but is down several percentage points from 2017.

- HVAC—Winners this year are Heat Pumps with traditional split-system and mini-splits making gains over Furnaces and Boilers.

- Roofing Underlayment—Traditional Asphalt Felt fell below 50% market share in 2108, and Mechanically-Fastened and Self-Sticking Synthetics have taken the lead.

- Faucet Finishes—Chrome and Nickel finishes are leading the market for faucets, Stainless is holding steady, and Bronze continues to lose market share.

- Flooring—This was a great year for most hard surfaces in flooring. Luxury Vinyl Tile and Plank saw strong growth over the previous year, particularly in kitchens, bathrooms, and basements—places where the product’s water-resistance is appreciated. Tile rebounded some in 2018, and Hardwood is still strong.

- The off-site housing boom is still a little way down the road; wall panelization and modular essentially maintained positions from 2017.

- Tankless Water Heaters grew in popularity, now representing nearly 40% of all water heaters installed in new SFD homes.

- Fire Sprinklers became more common in 2018—they’re now in about 11% of all new SFD homes.

- Painted Cabinets continue to grow quickly in popularity at the expense of Wood and Laminate finishes.

- Granite Countertops still remain #1, bouncing back some in 2018 with more than 50% of new SFD home kitchens despite the continued the popularity growth of Quartz.

Other categories we tracked this year:

Appliances | Bathroom Accessories | Beams & Headers | Cabinets

Countertops | Deck & Porch Railings | Ducts | Exterior Doors | Faucets

Fencing & Landscape Walls | Fire Sprinklers | Finish Flooring | Foundations

Garage Doors | Home Electronics | Home Mechanical Ventilation

Standby Generators | House Wrap & Radiant Barriers | HVAC Systems

Infrastructure | Insulation | Interior Doors | Interior Finish Materials | Lighting

Outdoor Structures | Patio Doors | Plumbing Fixtures | Plumbing Piping

Roofing | Roofing Underlayment | Sheathing - Floor, Roof, Wall

Siding & Exterior Finish | Soffit, Fascia, & Exterior Trim

Structural Systems - Floor, Roof, Wall | Swimming Pools | Underlayment

Vapor Retarders in Walls & Ceilings | Windows

Why Trust Home Innovation’s Builder Practices Reports?

Our reports are far more than just summary tabulations of a national survey of home builders. We employ a robust market demand modeling methodology that compiles volume and type of products and materials purchased. We report market demand for single- and multifamily properties separately.

We’re also providing more options than ever in data format. The large survey sample size allows data subscribers to get a very granular look into county, metro area, state, and regional markets for new home products purchases. This year, the Builder Practices Reports will be available in both tabular and database formats that give you more analysis options, including analysis via business analytics and mapping software.

For more information, contact me via email or call 301.430.6305.

Back to Top