Ed Hudson, MBA

March 18, 2020

Looking for a Needle in a Haystack? We’ve Got It!

Finding and surveying a consumer group with specific home repair or remodeling purchase experience can be challenging, at best. Sometimes, it’s like looking for the proverbial needle in a haystack. Here’s why it can be so difficult — each year…

- One household in 5 purchases interior paint

- One in 8 purchases flooring

- One in 10 purchases a new plumbing fixture

- One in 20 purchases roofing, an exterior door, or countertop

- One in 50 purchases shutters

- One in 100 purchases a radiant floor heating system

Surveying low-incidence home improvement product purchases is time-consuming and costly, and it often nets disappointing results. Many researchers end up “lowering the bar” and allowing marginally qualified responses in just to satisfy quotas. Don’t let the hard-to-find nature of your next survey negatively affect the quality of your research—Home Innovation Research Labs has a service specifically designed to help.

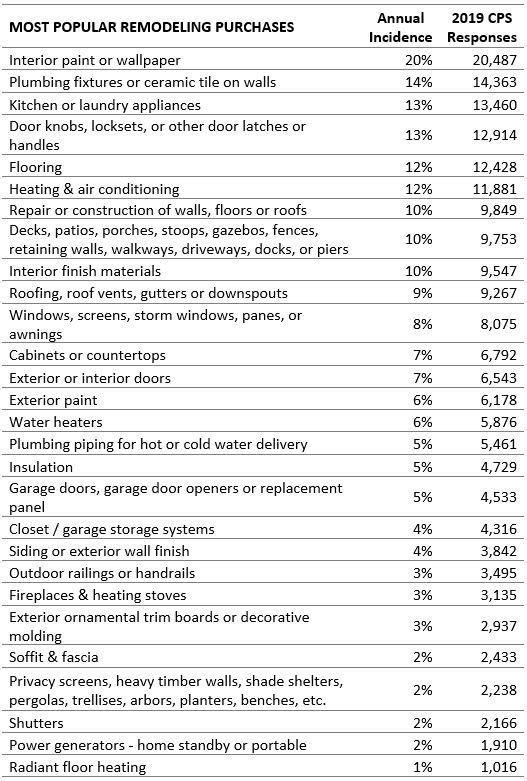

Each year, we survey more than 100,000 households in our Consumer Practices Survey (CPS) regarding their repair and remodeling purchases. Using the CPS database, we can profile consumers by very specific demographic and home improvement activities in the previous year, providing a shortcut to finding your target market research audience. This panel is especially helpful in finding users and purchasers of unique or low-incidence products and materials. Here are counts and annual purchase incidence rates* from our 2019 CPS database by product category:

*Annual Purchase Incidence Rates approximate the percentage of the U.S. population who undergo a purchase at least once a year

In addition to recent purchases, we have much more information about these consumers—including demographics, DIY or hire-a-pro project, materials place of purchase, and future intentions to undergo a remodeling project.

Our pre-screened consumer panel is ideal for Customer Journey research. We can drill down more deeply into topics surrounding their specific purchase, such as:

- “Where did you learn about the product?”

- “What were the alternatives you considered?”

- “How did you investigate or try the product?”

- “What were the most important factors in choosing it?”

- And many others.

Our 2020 CPS will come out of the field very soon (late March 2020). Contact us to learn more about this service, or to get a quote on feasibility for your next survey of consumer for home remodeling.

Back to Top