Ed Hudson, MBA

May 11, 2020

Brushstrokes & Chill: Interior Painting, Outdoor Living Get Boost During Stay-At-Home

Occasionally, unforeseen opportunities arise in the course of research where data can be analyzed for a purpose that was not originally intended. Collecting data from our 100,000-response Consumer Practices Survey (CPS) occurred from mid-February to mid-April 2020; this collection period spanned the period of time when we first began seeing COVID-19 as a serious threat in the Unites States and governments began restricting certain businesses and activities.

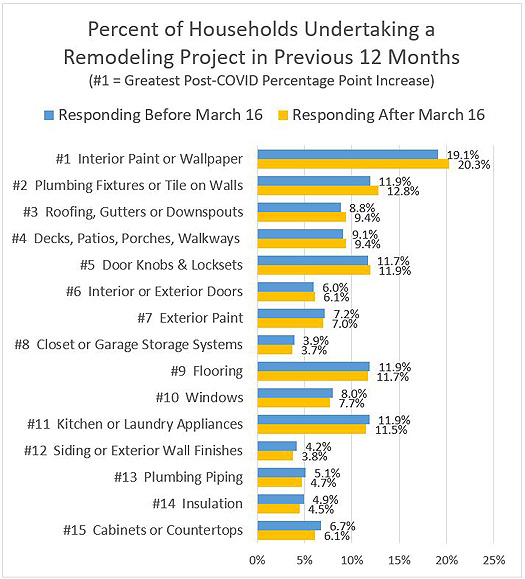

The CPS asks consumers about their home improvement activities in the previous 12 months. Over the two months of data collection, we saw reporting of some remodeling activities increase while others decreased. Findings indicate that Paint and Wallpaper got the biggest percentage-point boost after March 16th, while Cabinet and Countertop projects took the biggest hit. Others seeing a boost included Plumbing Fixtures (faucets, sinks, toilets, etc.), Outdoor Living (decks and patios), Gutters and Downspouts, and Interior Doors. Categories experiencing a drop included Exterior Finishes and Trim, Insulation, Appliances, Windows, Flooring, and new Plumbing Piping.

In the graph below, the top bar indicates the percent of households undertaking a remodeling project, by category, reported by survey respondents prior to March 16, 2020, for the previous 12 months. The lower bar in each pair represents the percent of households undertaking the same type of project in the previous 12 months who reported after March 16th. Categories where the bottom percentage (later in the COVID-19 crisis) is greater than the top suggest that remodeling activity in that category is escalating. Painting and Wallpaper represent the greatest increase in activity as the COVID-19 crisis has progressed. At the other end of the spectrum—where the percentage fell the greatest amount after COVID-19 restrictions were imposed—was the purchase of Cabinets and Countertops for home remodeling. The categories are ordered from greatest increase to greatest loss from before to after March 16th.

Source: Home Innovation Research Labs' Consumer Practices Survey

While you can see from the chart that differences in annual incidence rates are small, these represent the full 12-month period prior to respondents completing the survey. Those received after March 16th only included about one month of buying behavior after COVID-19 restrictions were put in place. Therefore, a small change here may indicate the beginning of a more a more significant shift as 2020 progresses. It will be interesting to see how these results compare to those six or 12 months from now.

Of course, these changes could be just temporary and a result of the change in consumer behavior due to current shelter-in-place restrictions. However, they may be leading indicators of a new pattern of thinking and behavior in the wake of the COVID-19 pandemic. Either way, this topic needs deeper investigation as providers of remodeling products and services race to ascertain what the “new normal” will be in months and years to come.

In the next few weeks, we will have the full findings of the Consumer Practices Survey available for analysis and purchase. These will include very specific product details, along with materials place of purchase, and whether projects were carried out by remodeling pros or by do-it-yourselfers. Contact us to learn how you can take advantage of this new and timely remodeling market intelligence.

Back to Top