Ed Hudson, MBA

March 9, 2018

Building Codes and Market Change: Do Codes Lead, Follow, or Coincide with Industry Practice?

Based on my past 25 years of researching innovation in home construction, I’ve seen the impact of building code changes on market and industry practices. Normally, however, it’s industry and market adoption of superior building practices that lead to building code changes. The typical process goes like this:

- First, an innovative builder or manufacturer (or a combination) creates a solution that offers improved home performance.

- Next, technology and manufacturing developments make that solution cost-effective.

- Then, if there is market demand for the solution, the industry learns how to incorporate it into building practices.

- Finally, after a portion of the industry demonstrates the new solution as viable, building codes gradually raise minimum performance requirements to pull the remaining market into the new practice.

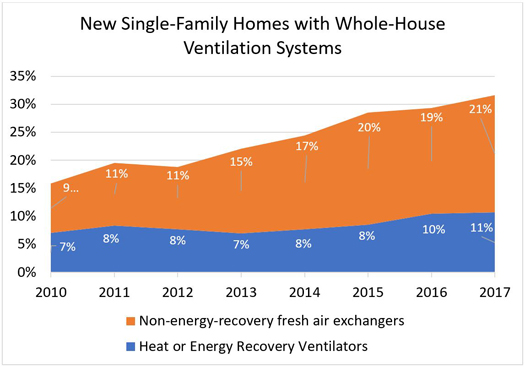

But occasionally, code changes happen before practical industry solutions are ready, which can lead to some unpredictable market reaction. You can see an example of this in the graph below. While it does show market change coinciding with more stringent ventilation requirements, it does not show market adoption of energy and heat recovery whole-house ventilation systems happening at the pace that many would anticipate.

Source: Home Innovation Research Labs Annual Builder Practice Survey

In 2010, respondents to our Builder Practices Survey reported about 16% of the homes they built included whole-house ventilation systems; slightly less than half were either heat- or energy-recovery systems. After 7 years of progressive growth, about double the number of new homes were reported to have whole-house systems, with a much greater increase seen in non-energy-recovery systems compared to HRV/ERV systems. This is ironic since the increased need for ventilation is a result of energy-saving measures — i.e., the tightening of building envelopes to allow less conditioned air loss. Hence, I believe this category is ripe for a simple, energy-efficient solution.

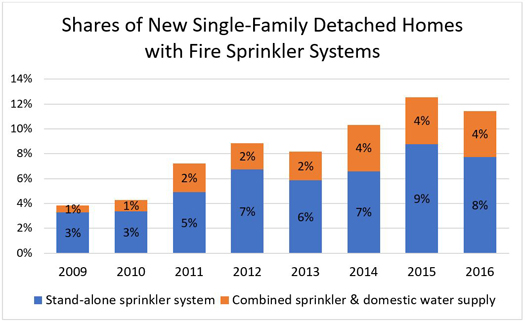

Another category where market and industry practices have lagged behind code changes is with fire sprinklers in single-family detached homes. In some cases, code provisions are “amended out” of the codes or not enforced by most states and building jurisdictions. This is another example where innovation can provide a workable solution, or where market education can create an opportunity for building product manufacturers. One possible cost-effective solution for sprinklers is the combined domestic water supply and sprinkler system, which Home Innovation has been tracking since 2009, and which now (2016 survey) represent about one-third of all sprinkler systems in new single-family homes.

Source: Home Innovation Research Labs Annual Builder Practice Survey

As manufacturers look for opportunities to offer solutions for higher performing new homes, you can also consider the example of R-value requirements. The required R-value of ceiling insulation is often more than double that of wall insulation, but R-value of a window assembly is only a small fraction of the walls surrounding them. Why the difference? Primarily because it’s currently most practical to get the highest R-values in attics, rather than in walls and windows. If technology and industry education can offer practical ways to get similar R-values for walls and windows, then the industry is likely to adopt them and code requirements will gradually increase.

These examples beg the question, “Which practices will the industry most readily embrace when model codes change?”

A few years ago, Home Innovation included questions in our Omnibus Survey of builders about the potential for higher R-value requirements for exterior walls. We asked which of several alternatives respondents were most likely to adopt if they were required to increase R-value in walls. Builders responded that they were most likely to use 2x6 studs instead of 2x4, followed by using an insulation material with a higher R-value-per-inch insulation (like spray foam). These responses have been borne out in the past several years of tracking — 2x6 wall framing is now in more than 40% of all new homes, and spray foam has grown to more than 12% of all exterior wall insulation material.

Home Innovation’s marketing research practice has decades of experience in helping companies find opportunities in the market by evaluating current needs and performance gaps. If you’d like to discuss how we can help you do this, get in touch.

Back to Top