Ed Hudson, MBA

August 20, 2020

COVID-19 Brings New Mix of Customers, Product Sales to Pro Yards (Part II)

The national news and trade press have regularly kept us up-to-date on the COVID-19 traffic boost in home improvement warehouse (HIW) stores, largely due to their visibility with retail locations across the country and publicly-traded stock, which makes information on their performance readily available.

So how are things faring among retailers and dealers who service the construction pro channel, such as lumber and specialty building materials dealers? This channel is responsible for supplying a large share of the building materials for new homes, commercial buildings, and large remodeling projects and is the primary channel-to-market for many manufacturers of building materials. To help keep the industry up-to-date, Home Innovation teamed with Webb Analytics in August 2020 to conduct a survey of the pro dealers to determine how COVID-19 is impacting its business and how it is responding to the new market environment. From this study, we’ve uncovered some opportunities that can help suppliers serve this channel better.

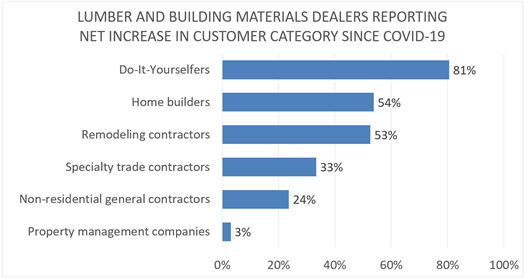

One question we asked was, "Since COVID-19, have your sales to any of the following customer categories increased, decreased, or remain unchanged?"

The graph below represents the net increase, or number of respondents stating “increased” minus those who stated “decreased.” Overwhelmingly, this traditionally pro-oriented channel saw a jump in sales to consumer do-it-yourselfers (DIYers). Home builders and remodelers also fared very well with a reported net increase of more than a 50%.

Some respondents postulated that DIY homeowners are looking to avoid the crowds at HIWs. These DIYers provide a welcome infusion of cash sales into this channel, which normally operates on credit with their pro client base. Serving walk-in DIY customers offers a challenge to this normally pro-orientated channel, however. Extensive merchandising displays are generally absent at pro-oriented retailers, and staff need to become accustomed to providing hand-holding that normally accompanies this type of customer. Suppliers who are willing to assist retail locations to become more proficient at servicing consumers stand to gain ground among pro dealers.

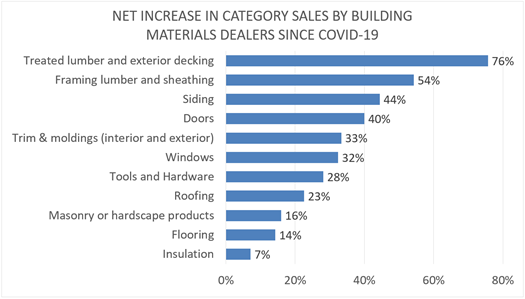

Another question we asked was, "Since COVID-19, have you seen a growth or decline of sales for each of the product categories listed below?"

Using the net increase calculation like the previous question, pro dealers overwhelmingly reported an increase in sales of treated lumber and decking products — primarily destined to improve outdoor living environments at homes. Following at a distance were framing lumber and sheathing materials — used primarily when new living space is being constructed as a new home or building, or addition to an existing home or structure. It is noteworthy that respondents reported increases in sales among all categories compared to pre-COVID sales.

This increase in demand, particularly with lumber for outdoor living materials, has resulted in shortages reported across the country and an opportunity for alternative products to gain foothold in this market. One dealer commented that with shortages of certain materials, it had become more evident that relying on a single supplier for a category of materials was not a good strategy.

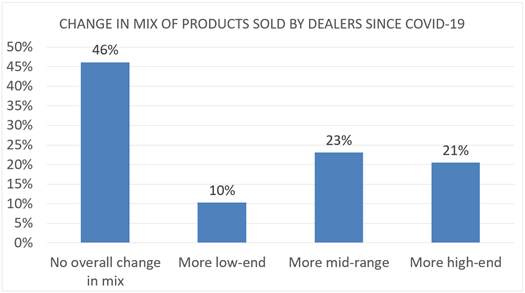

Another question was, "Overall, considering the mix of products and materials your company sells, have you noticed an increasing share of low-end, high-end, or mid-range products since COVID-19?"

The findings in the graph below show that, overall, there has been only a modest change in the price-point mix, generally favoring mid-range and high-end products over low-end products.

This finding may reflect limited availability of builder-grade materials. When standard-grade materials are unavailable and customers need to complete a project, they have only mid-range and high-end products available to purchase. The modest increase in mid- and high-end product sales may also signal that the market is undergoing a change in values, favoring improved functionality or aesthetics over bare minimum, as we make our homes more livable in the wake of COVID-19. Nonetheless, it represents an opportunity for high-end product manufacturers that are not normally considering lumber and building materials dealers to break into this channel.

Implications for Manufacturers and Suppliers

With such as vast transformation underway, it serves manufacturers and suppliers to do a deeper exploration of how they can better serve the lumber yard and building materials dealer segment. For years, some pro-oriented dealers have sought how they can woo consumers away from HIWs — with little success. For manufacturers, this may involve a second look at consumer-friendly products for this segment; merchandising displays or on-site support; and/or more remodeling-focused offerings, particularly with outdoor lumber and hardscape materials. With many materials in short supply and some buyers being more open to alternatives, there may be additional opportunities for providers of innovative products and materials.

Also, due to some supply issues and buyers’ decrease in price sensitivity, there may be opportunities for suppliers of value-added or up-scale materials. Often, these suppliers avoid the pro dealer/lumber yard channel due to lower potential margins and price competitiveness. But they may need to rethink it as an opportunity to expand.

If you are considering conducting research among lumber and specialty building materials dealers, contact us. We can discuss our recommended approach and how we can obtain feedback from this channel on your behalf. We offer a wide variety of marketing research services, such as in-depth interviewing, focus groups, and custom surveys that can be adapted to meet your specific information or market data needs — despite the limitations imposed due to COVID-19.

Back to Top