Ed Hudson, MBA

March 14, 2022

COVID Changes - Temp or Perm? Part 2

A few weeks ago, I shared the overall findings from a survey of builders on the permanence of 22 business and new home changes adopted during the pandemic (click here if you missed it). As suspected, we found that virus-mitigating practices such as masks and social distancing at the jobsite, offices, and model homes are likely to fade when the pandemic is deemed to be over. However, it seems that most other changes will be retained by more than half of builders responding to the survey. These include practices such as utilizing a greatly-expanded network of building product suppliers, and putting more emphasis on outdoor living space, healthier indoor air quality, and home layout changes that provide space for remote work and schooling.

I recently had the opportunity to dig deeper into the findings of this study with a presentation I delivered to the Leading Suppliers Council at NAHB’s International Builders’ Show. This deeper investigation included comparisons between how big and small builders responded to the pandemic, as well as custom and production builders. We even compared regional/national builders to builders who operate in a single geographic area. The full presentation is available here.

Excerpted from Ed Hudson’s presentation to NAHB’s Leading Suppliers Council, Jan. 2022.

Here Today, Gone Tomorrow? COVID-Prompted Home Building Trends

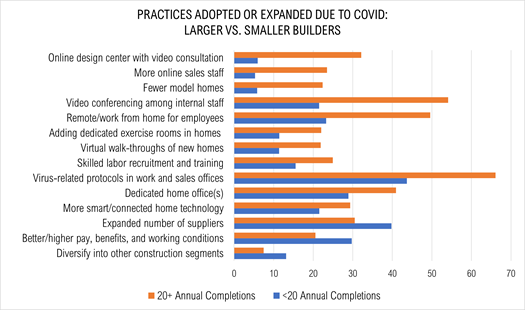

In summary, our analysis found that larger builders – those constructing 20 or more homes per year – were more likely to adopt business changes than were smaller builders in 15 of the 22 categories rated. This debunks the stereotype that larger builders are slow to change. Further, regional/national builders were more likely to adopt changes in 20 of the 22 categories than were local builders. Drilling down a bit to the individual practices, larger builders were about 4 times as likely as smaller builders to institute a video-based design center; 3 times as likely to add online sales staff; and more than twice as likely to reduce or eliminate the use of model homes.

However, there were a few areas where smaller builders said they were more likely to maintain some of the pandemic-era changes than larger builders. For example, since smaller builders have less buying power, they are having to work much harder to source building products and have found it even more necessary than big builders to expand their supplier networks. Further, smaller builders have greater difficulty attracting employees than larger builders, since they are not able to provide the same kind of career path, so they were therefore more likely to increase pay and benefits to keep and hire workers. Perhaps as a result of the difficult working environment imposed by the pandemic, smaller builders were also more likely to diversify their operations than were larger builders.

Regarding new home features, custom builders placed more emphasis on improving outdoor living space and energy efficiency than did production builders, but production builders put more emphasis on indoor air quality and home office space than custom builders.

Do these findings ring true for what you’ve seen in your market? Let me know. And if you want to better understand how your building product company can improve its marketing and messaging strategies to adopt to these new market conditions, contact me to discuss how our marketing research services can help.

Back to Top