Ed Hudson, MBA

April 4, 2022

Current Market Trends & New Opps Revealed for Plastics In New Construction and Remodeling

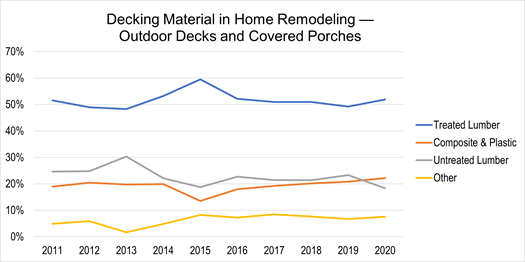

On March 1st, I was pleased to speak at the opening session of AMI’s 2022 PVC Formulation Conference in Cleveland. I provided an overview of product trends in new homes and remodeling from 2011 to 2020, tracking market shares of PVC and other plastics products. I concluded with a discussion of how the past two tumultuous years are now resulting in opportunities for plastics. I covered the product categories where PVC is already a big player in the market, and those where they could become one, including flooring, piping, siding, decking, fences, and others.

Source: Home Innovation’s Annual Consumer Practices Reports

In reviewing data from Home Innovation’s Builder and Consumer Practices Reports, I pointed out where PVC and Plastics market share is rising and falling; which competitive products they were gaining and losing share to; and the rationale behind these market dynamics. At the conclusion of the presentation, I shared opportunities to grow market share by offering products that solve major industry issues, including:

- Solving labor issues by developing and promoting products that are easy-to-install, can be installed by lower skilled workers, in a reduced number of steps, and without requiring return trips to the jobsite.

- Targeting younger generations of buyers who favor engineered products and solutions, unlike older buyers who lean more heavily toward natural and traditional materials such as wood, stone, and ceramic tile.

- Taking advantage of the high prices and price volatility of lumber to consider expanding product offerings in fence materials, flooring, decking, siding, trim, and window and door frames.

- Applying technology advancements in the luxury vinyl flooring category to other home finishes besides floors, both indoors and outdoors, to develop products engineered to be as attractive as wood yet easier to install, maintenance free, and potentially more durable.

- Capitalizing on the boom in expanded and upgraded outdoor living areas that were already a hot trend before the pandemic but are now “off the charts.” Growing trends in this category include consumer desire for bigger and better spaces; higher quality and more attractive appearances; outdoor kitchens; roofs over decks and patios; and more privacy fences and screens. This also includes an uptick in demand for moving window walls between indoor and outdoor living areas where attractive, high-strength PVC window and door frame materials could fit the bill.

- Supporting changing lifestyles initiated or accelerated by the pandemic, such as the desire to spend more time at home. This includes consumers looking to expand living areas through decluttering or converting basements, garages, and attics into living areas; new additions or detached storage buildings; and creating dedicated work and schooling areas.

You can take a look at my full presentation to see how home remodeling purchases have trended in the past decade. Ove the coming few weeks, we’ll be publishing our 2022 Consumer Practices Reports, which will provide an updated view of market trends in remodeling — in 25 product categories, regions, states, and metropolitan areas, in both the United States and Canada. Contact me to learn how you can gain access to the 2022 data and stay abreast of the latest trends in the remodeling products market.

Back to Top