June 23, 2017

Market for Building Materials: Moving Towards the Middle?

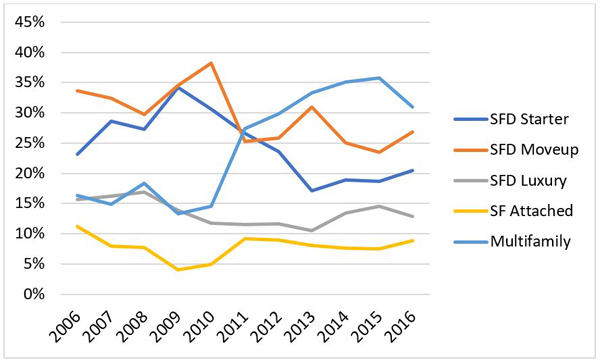

The housing rebound continues, but its effect hasn’t been evenly distributed across the spectrum of housing types and price-points. In 2006, Multifamily represented only 16% of residential starts but surged to 35% of starts in 2015, bringing a new character to the market for home building materials. In 2016, however, while we saw a modest return to pre-2006 markets when Move-up and Starter homes ruled, Multifamily began inching its way back down from its peak the year before.

Monitoring this evolving mix is one key factor in predicting where the market is going. Home Innovation’s 2017 Builder Practices Survey captured many new trends and trend reversals, with some predictable effects of the change in housing mix, and some others that were surprising.

Shares of New U.S. Homes Built by Type and Price-Point

Source: Home Innovation Research Labs, Inc.; Annual Builder Practices Survey

Overall, there is a substantial movement toward the middle price-points in the market. This is shown by a reduction in the share of Luxury homes, whose average cost/selling price in 2016 was highest ($500,000); as well as a reduction in the share of multifamily housing, whose average cost/selling price per unit is the lowest among all the categories ($150,000). In contrast, the share of Single-Family Detached (SFD) Move-up homes saw the sharpest increase. SFD Starter home and Townhouses (SF Attached) also saw moderate increases in market share.

How did these changes affect the market for building materials? We would expect the very high-end and very low-end materials to be most negatively impacted, and the 2017 Builder Practices Reports found this to be true in some cases, but not all. Let’s look at what the change in housing mix did to the popularity of certain materials in kitchens and bathrooms last year.

Bear in mind, most building product types are either growing or declining in market share to some degree from year to year, and very few are static. Hence, a “movement towards the middle” may result in an acceleration in a growth trend or decline as well as turning moderate growth to moderate decline. One example is with jetted tubs, whose popularity in new homes has been declining for many years. In 2015, they were installed in about 15% of new homes, but that fell abruptly to about 11% in 2016. The decline of Luxury homes was also reflected in shares for natural granite and marble shower and bathtub surrounds, which took a big tumble from 12% to 9% in the past year. High-end enameled cast iron and granite sinks likewise lost share, while the lower- to mid-range vitreous china and enameled steel sinks both saw a boost. At the lowest end of the spectrum, one-piece cultured marble sinks and countertops tumbled from 24% to 18%. Unexpectedly, and likely bolstered by both demographic and style trends, the popularity of bidets continued, growing from about 6% to 7% of all new homes in the past year.

On the kitchen floor, high-end solid hardwood and luxury vinyl tile held steady while engineered hardwood and ceramic tile both saw a boost—each growing 3 percentage points in their market share. Natural stone (marble, slate, and granite), staples in Luxury homes, fell from 6% to 3% share. Likewise, vinyl sheet flooring, most popular in Multifamily homes, fell abruptly—from 12% to 8%. In the bathroom, natural stone also fell from 8% to 5% of bathroom installations, while ceramic tile grew from 65% to 68% of all bathroom flooring.

The whole “movement to the middle” characterization of the new market seems to hold well until we get to countertops. Quartz countertops, despite being among the most expensive products in their category, had their best year ever in new homes—growing from 9% to 13% in bathrooms, and from 9% to 15% in kitchens. Granite, on the other hand, lost several percentage points of market share in both kitchens and bathrooms.

The movement also had conflicting impacts on certain faucet styles. Nickel finished faucets, for the first time, are the most popular finish in kitchens, outselling stainless steel, chrome, bronze, and others. In the bathroom, nickel also gained ground at the expense of all other major categories except for chrome, which narrowly hung on to its top position. Style trends also had their impact on faucets: two-control faucets saw a big jump in both showers and lavatories, but a slight decline in the kitchen.

How is the move to the middle already affecting your product category? How will it affect it in the future? Home Innovation can help you figure out how to best position your product for the housing mix of today and tomorrow -- contact us today.

Back to Top