December 14, 2018

December Survey of Builders Reveals Quickening Pace in Transitioning to Off-Site Construction Solutions

Off-site construction. We’ve all heard the buzz about builders moving to this “new” way of building, especially in light of the current skilled trade deficit in our industry. But what are home builders actually planning to do about it this year? Or even in the next five years? There are a lot of contenders in the off-site space, but where is the market actually headed?

A just-released Home Innovation Research Labs survey (conducted in December 2018) revealed the pace of transition from on-site to off-site construction is picking up. We also found that, contrary to some industry thinking, the competition amongst various off-site housing solutions will not likely be “winner take all.” Rather, it looks like several different solutions have their own followings and will be able to grow.

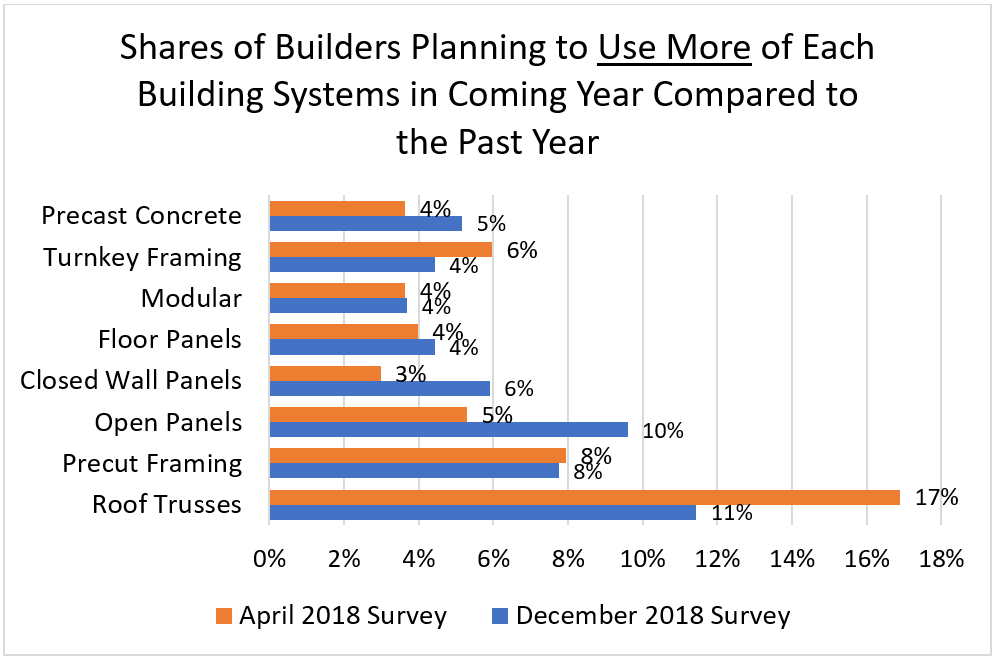

In April 2018, Home Innovation conducted a survey of 300 U.S. home builders. We included a list of seven off-site home construction practices that asked builders about their anticipated use of each in the coming year. In December, we repeated the exact question in another builder survey to gauge any change in builder sentiment — and we definitely found some. Knowing that adopting a new way of building homes can require years to implement, we also included a new question to gauge builders’ anticipated use of off-site systems in five years.

Changing Sentiment from April to December 2018

During the 8-month period between the two surveys, Roof Trusses continued to be the top choice for builders adopting an off-site building system. About 70% of respondents in both surveys said they would continue using roof trusses. In April, 17% of builder respondents stated they would increase their use of trusses in the coming year, while only 11% stated the same in the December study. While this was a decline, it was not enough to drop trusses from the top spot among off-site construction options.

Source: Annual Builder Practices Reports, Home Innovation Research Labs

The two categories that saw the greatest increase from April to December were Open Wall Panels and Closed Wall Panels, where double the number of builders stated they planned to increase their usage of these systems.

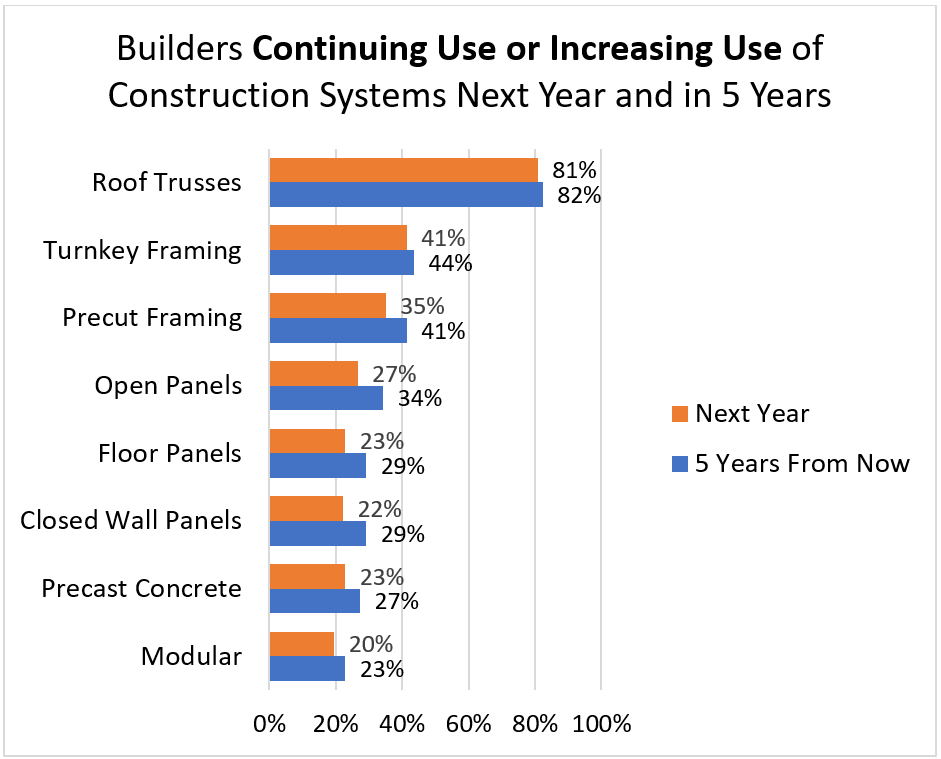

Plans for the Future: Expected Usage Next Year & in Five Years

Not surprisingly, the vast majority of builders in the December survey expected to be using Roof Trusses both in the coming year, and in five years. Little increase between the one-year and five-year usage expectations makes sense because Roof Trusses have a mature market; builder thinking about a mature technology will likely not change over the coming few years.

Fewer than half of those surveyed in December plan to purchase Turn-key Framing services, where the framing contractor provides both the framing package and installation labor. Like trusses, the one- and five-year differences were small.

More than 40% plan to use Pre-cut Framing packages, where most structural components in floors and walls are cut to precise measurements and assembled at the jobsite. Unlike the first two systems, we observe a 6-point increase between one- and five-year use expectations, indicating builder thinking seems to favor this option and see transitioning more to its use.

Similarly, Open Wall and Floor Panels finished at 34% and 29%, respectively, for anticipated five-year usage – that’s a 7-point increase over the one-year expectation for both. Closed Wall Panels fared well, too, at 22%, with builders anticipating five-year usage 7 percentage points ahead of the coming year usage. This is a very positive signal that builder thinking is beginning to “gel” around these options. Precast Concrete and Modular also did well, with 3- and 4-point increases from one- to five-year expected use.

Source: Annual Builder Practices Reports, Home Innovation Research Labs

Based on a deeper analysis, I believe that Open Wall and Floor Panels are going to be on the front edge of this market increase, using the existing widespread network of shops and factories around the country. They are a less radical change for builders than some of the other options. However, I believe as capacity ramps up in Closed Wall Panel systems, this form of off-site construction will see a dramatic upswing, as well.

There are additional opportunities in this space for Modular and Precast Concrete. The industry is already very familiar with Modular, and capacity and technology exist to support its growth. Precast Concrete Panels, however, are used less often for above-grade residential structures in the United States and will need more time to gain footing in the market.

While not included in this survey, manufactured housing is showing some evidence of resurgence with a high upside potential, especially considering demographic changes that favor younger buyers, rising housing costs, and improvements in design within the manufactured housing sector.

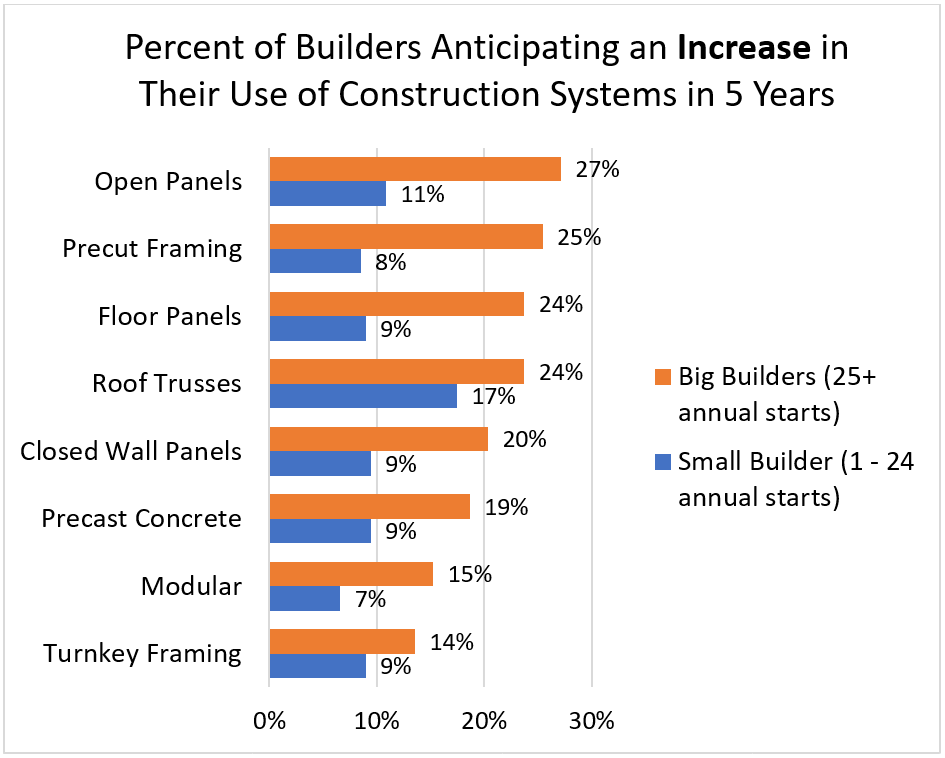

Bigger Builders More Likely to Adopt Off-Site Solutions

Looking at the data by Size of Builder, there’s a vast difference in builder thinking. Mid-sized and larger builders, defined as those building 25 or more homes per year, were more than twice as likely than smaller builders to tell us they anticipate using one of the off-site construction technologies for housing in the coming five years. This is very important for a simple reason—builders who construct 25 or more homes a year are responsible for about 75 percent of all new housing construction. The number one option among large builders was Open Wall Panels, followed closely by Precut Framing Packages, and pre-assembled Floor Panels.

Source: Annual Builder Practices Reports, Home Innovation Research Labs

In the coming weeks, I’ll be digging deeper into these findings to share some more insights. Stay tuned! In the meantime, we are now organizing to conduct focus groups at the 2019 International Builders’ Show, which will be held in Las Vegas in February. Contact me if you would like feedback from the active, engaged industry professionals who will be attending the 2019 show.

Back to Top