September 2, 2014

Survey Says: Home Insulation Trend Reversal?

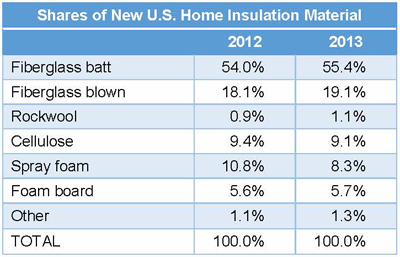

Twenty years ago, 90 percent of cavity insulation installed in new homes was fiberglass batt or loose fill, with the balance largely shared between cellulose in ceilings and above-grade walls and foam board for foundations. More recently, alternative insulating systems have multiplied – blow-behind-mesh systems, spray-applied fiberglass, structural insulated panels and ICFs using rigid foam, spray foam, and others. While many of the newer systems have found a strong following, spray foam experienced dramatic growth. This growth occurred largely over the past five years, as reported by Home Innovation's Annual Builder Practices Survey (ABPS), a national survey of 1,300 home builders. In 2008, spray foam represented about 3 percent of insulation in all new home insulation. By 2012, its share had nearly quadrupled to 11 percent of the market. In 2013, however, the tide shifted. The APBS revealed spray foam's share had fallen back to 8 percent, declining across the board—in walls, floors, and roofs and in each of the four Census Regions. Fiberglass batt and blown claimed the majority of the share lost by spray foam. While we all recognize that a one-year data shift does not constitute a trend in building product usage, this may be signaling a change in the home insulation landscape.

Source: Annual Builder Practices Survey, Home Innovation Research Labs

Who Uses Spray Foam Insulation?

Our research has shown that some home builders are willing to pay more for spray foam insulation than for alternatives, running counter to the opinion that builder purchases are entirely driven by cost.

- Spray foam insulation is twice as likely to be used in luxury homes as in move-up homes, and four times more likely than in starter homes.

- Small builders (i.e., those who build <10 homes/year) are twice as likely to install spray foam as are large builders.

- Single-family builders are far more likely to use spray foam than multifamily builders.

Why the Explosive Growth of Spray Foam?

The phenomenal growth rate of spray foam surprised many in the home building industry, which is not known for rapid change. Spray foam, however, seemed to respond to numerous issues and opportunities happening within the industry. As home energy codes ratcheted up the minimum requirements for R-values and air tightness, builders reported switching to spray foam to simplify the air sealing process and to get a higher R-value in confined spaces, such as wall cavities. Others found using spray foam on the underside of the roof deck as a natural way to bring attic-located HVAC equipment and ducts into the home’s conditioned area for better energy performance. Some builders have regularly reported to Home Innovation that explaining the benefits of spray foam insulation to homebuyers is also easier and has a greater impact on energy efficiency than many other energy upgrades they can provide.

Why the Recent Decline?

The reasons for the decline of spray foam in new homes are not yet completely clear, but there are a few likely suspects. The 2013 ABPS revealed that home builders are economizing across multiple product categories, using fewer and less expensive materials. This was seen in porches, decks, windows, flooring, and other product categories. Also, other alternatives for increasing R-value and air tightening — which are the primary benefits of spray foam — are continuing to make inroads. Some examples include the Huber ZIP system, spray-on sealants like Owens Corning's EnergyComplete, denser fiberglass batts, foam board wall sheathing, and energy trusses.

Another possible explanation is a shift in homebuyer demographics. With spray foam more common in higher-end homes, the market shift toward multifamily rental homes (currently accounting for a third of all new home starts) has certainly weighed against spray foam insulation.

And there is another very simple reason that may be at play — some home builders tried spray foam insulation but have returned to the materials they were using before. A survey conducted by Home Innovation Labs in 2013 showed that 30 percent of builders who have used spray foam in the past are not using it now. In our research, we often hear builders state that fiberglass, by far the most popular home insulation material, is simply the most cost-effective, easy-to-install material for most applications.

The Future?

Future use of any product is virtually impossible to predict without extensive study of the factors that determine product selection — factors that are constantly changing. But what I will comfortably predict, based on these data points and decades of experience in housing industry research, is that the insulation market is highly competitive and any ground gained by specific product categories within the market will be harder won than the gains made in the past.

For more specific information on the current state of the insulation market, and/or the markets for other home building products, materials, and systems, contact us about our Annual Builder and Consumer Practices Reports.

Back to Top