April 1, 2021

Where Did We Buy? Purchase Location for Home Remodel Projects

Not all building materials purchase outlets did equally well during the pandemic. As the responses from our latest Consumer Practices Survey came in, we were able to examine who did well, and in which product categories. With this rich data, Home Innovation is introducing the “Purchase Location for Home Remodeling Projects” report to provide market insight for retailers and suppliers of building materials.

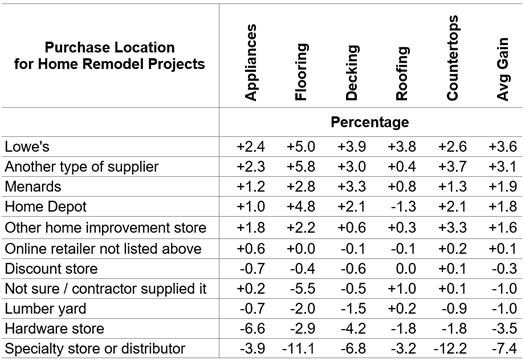

For more than 25 years, Home Innovation has been tracking volume and share of materials purchased for remodeling; Pro vs. DIY purchases; and purchase location and channel for the specific materials. Starting with our new 2021 Consumer Practices Reports, we decided to find out how purchase channel patterns shifted during the 2020 pandemic year. We compared the 2020 share of total purchases for each product category and specific purchase channel to those of 2018 for five important categories related to remodeling — appliances, flooring, decking, roofing, and countertops. Here is a summary of what we found:

Percentage Point Increase (or Decrease) in Share of Category Purchases of Remodeling Materials, 2020 vs. 2018

On balance, home improvement warehouse stores did better in gaining share — averaging about a 2 percentage point gain across the 5 product categories from 2018 compared to 2020. The biggest losses were for specialty stores — those that focus on a specific product category or group of related categories — which lost an average of more than 7 percentage points in share of remodeling purchases. Other channels showing a loss were hardware stores and lumber yards. Toward the middle of the pack, remaining virtually unchanged, were online retailers and discount stores. Some of these changes undoubtedly resulted from the resurgence of the DIY sector in 2020, and DIYers tend to buy more from retail channels than pro channels. However, the lack of growth in online purchases of these building materials is surprising in light of the efforts to social distance over the last year.

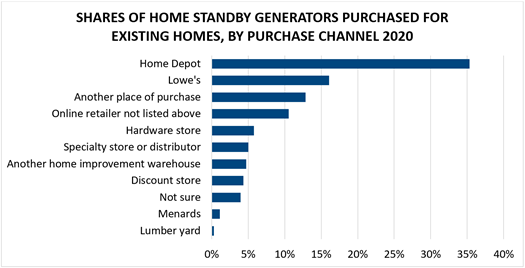

Our new Purchase Location for Home Remodeling Projects report reveals place of purchase for each of 36 product categories during 2020. Here is an example of National-Level data from this report for Home Standby Generators.

Source: Home Innovation Research Labs 2020 Consumer Practices Survey

The full Purchase Location Report contains specific place of purchase shares for all the following product categories at National, Census Division, and 50-State levels

- Appliances

- Bathroom Accessories & Shower Doors

- Cabinets for Kitchen & Bath

- Countertops (LF or SF)

- Deck & Porch Railings

- Exterior Doors

- Faucets

- Fencing & Landscape Walls

- Fireplaces & Stoves

- Finished flooring

- Garage Doors

- Home Standby Generators

- Home Portable Power Generators

- Home Mechanical Ventilation

- House Wrap & Foam Under New Siding

- Insulation

- Interior Doors

- Interior Finish Material

- Outdoor Structures (decks, patios, etc.)

- Other Outdoor Structures (planters, benches, etc.)

- Paint

- Patio Doors

- Plumbing Fixtures

- Plumbing Piping

- Radiant Floor Heating

- Roofing (SF or SQs)

- Roofing Underlayment

- Sheathing-All (Floor, Roof, Wall)

- Siding & Exterior Cladding (SF or SQs)

- Soffit, Fascia, and Exterior Trim

- Storage Systems for Garage & Closet

- Storm Doors

- Structural Systems-All (Floor, Roof, Wall)

- Tile Backing & Underlayment

- Water Heaters

- Windows

Interested in how retail channels performed during the pandemic year by these product categories? Contact us today.

Back to Top