April 16, 2021

2020 Hindsight: 2021 Builder Practices Reports Now Available

Exciting news – the 2021 Builder Practices Reports are ready! These provide the first look at how the pandemic year of 2020 changed building materials purchases for new homes.

2020 Market Changes

The year 2020 was characterized by price instability, supply disruptions and shortages, and even mandated business closures in some areas. We also saw an unexpected boost in new housing construction that started early in the year and continued. Considering these factors, we anticipated some changes in building materials purchasing patterns; only some of that anticipation played out.

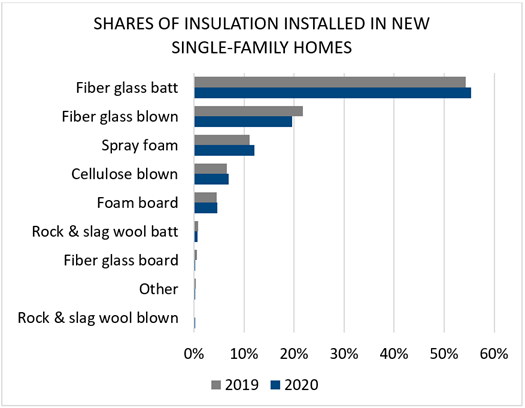

Looking at the 2021 Builder Practices Reports across all categories of materials, there is stability overall. However, there were some notable changes, both expected and unexpected. The running themes of the transitioning market included efforts to control runaway costs; labor-saving methods and materials; and an increased focus on home occupant privacy. Here is an example of how the pandemic affected the new home market for insulation.

Source: Home Innovation’s Annual Builder Practices Reports

Some of the most significant changes were seen in structural lumber. Prices skyrocketed during the pandemic year due to constrained supplies and significantly increased demand. Some lumber-conserving methods — such as roof and floor trusses — saw increases over dimensional lumber equivalents. Further, concrete slab-on-grade foundations and floors grew at the expense of basement and crawlspace foundations that generally have wood-intensive floor systems of joists and subflooring. Wall framing and sheathing were generally unchanged, with only some substitutions of plywood for OSB noted, likely due to price and availability issues. Only a slight change was seen in stud depth, favoring lumber-saving dimensions such as 2 x 3 and 2 x 4 over 2 x 6. Factory-built wall panels in single-family construction saw a big boost, after many years of flat to declining shares, from 5.5% to 9% of new housing starts.

With the pandemic and renewed focus on pathogen-free air in living areas, we might have expected an increase in whole-home ventilation. Interestingly, the opposite occurred. Builders stating their homes had no whole-home mechanical ventilation system increased from 36% to 39.5% during the year. There was also a surprising decline in HVAC systems with high-performance air cleaners – going from about 22% to 19% over the past year.

On the outside of homes, fiber cement increased as a siding material – from 23% to 27% of new single-family homes – but engineered wood gained ground as a trim material. Shares of homes with housewrap declined — builders opting instead for alternative WRB and air sealing methods. Some data also showed that builders focused on streamlining the construction process and reducing cost. For example, there was a marked decrease in the use of caulking for air sealing of the building envelope and an increase in use of spray foam gap and crack sealant.

Other data revealed additional signs of builder efforts stave off rising construction costs in their selection of more cost-effective materials. For example, new homes saw a decline in both granite and quartz countertops, but a surprising rebound in solid surface countertops. For the first time in many years, builders reported an increase in use of 3-tab shingles and a decline in architectural, or laminated, shingles.

Built-in privacy seemed to be more important in new homes in 2020. The share of single-family homes with fences grew from about 32% to 34.5%, and the average height increased from 5.9 to 6.25 feet, indicating a higher share of privacy fences in the mix. Home interiors were also more compartmentalized, with the number of rooms increasing for the average house despite the new single-family homes having about the same living areas as the year before.

Easier and quicker to install, as well as easy-to-maintain, vinyl flooring continued its surge, growing from about 11% to 15% year over year. This was driven primarily by the newer LVT/LVP category of product, which provides a cost savings over the materials it substitutes like solid wood and tile.

And these are just some of the highlights of the rich, detailed data provided in Home Innovation’s Builder Practices Reports that span nearly 50 different product categories:

If you want to fully understand your product or material category, how it fared in 2020, and how to thrive in the current market, you need the 2021 Builder Practices Report. Contact us today.

Back to Top