May 3, 2019

Age is Just a Number, Even with Houses

It seems logical to assume that older houses—with more wear and tear, longer exposure to weather, and functionally obsolete features—are more likely to be remodeled or upgraded than newer homes. So, following that logic, owners of “elderly” homes should be better targets for selling home improvement products and upgrades, right? Not necessarily. Applying this age-old assumption blindly across all product categories can lead to lost opportunities for selling remodeling products and services to owners of newer homes.

Home Innovation’s 2019 Consumer Practices Reports provide insight into the relationship between home age and home improvement product purchases. It’s true, in a very general way, that older homes receive more care in the form of remodeling—particularly when it comes to interior painting, insulation, roofing, and windows. But it’s not true for all categories. The percentage of homes getting new Closet or Garage Storage Systems and Outdoor Living improvements (such as e.g., decks and patios), for example, spikes in the most recently constructed homes.

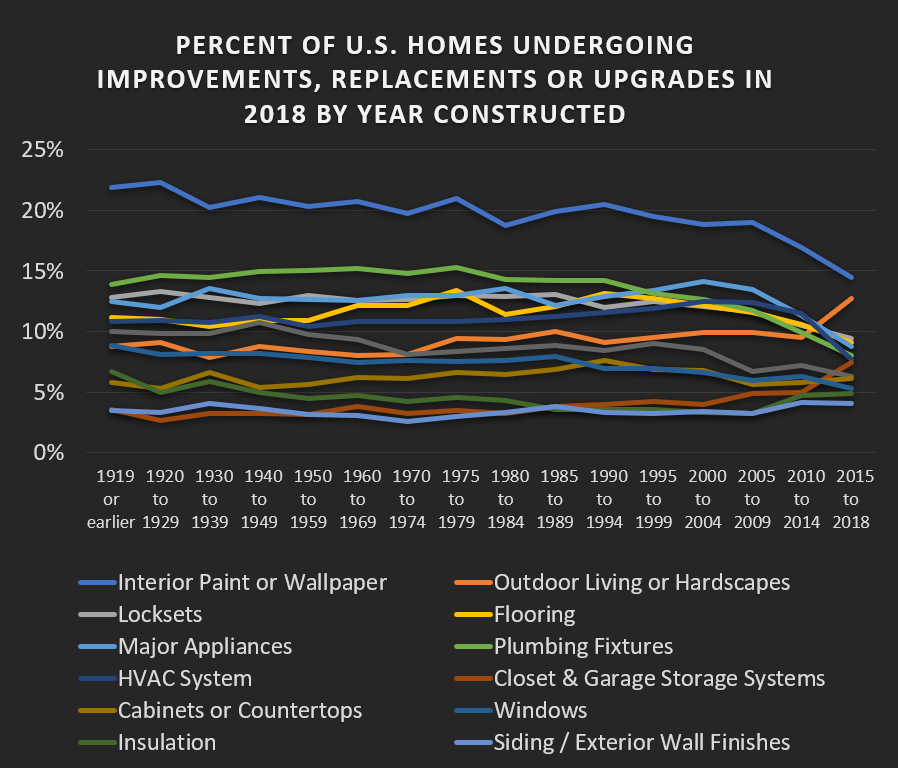

In order to better understand how a home’s age relates to specific remodeling activities, we analyzed our 2019 Consumer Practices Survey data to determine which categories of remodeling activity applied to various home vintages. The graph below shows some of what we found.

Source: Home Innovation's Annual Consumer Practices Survey.

It seems logical to assume that older houses—with more wear and tear, longer exposure to weather, and functionally obsolete features—are more likely to be remodeled or upgraded than newer homes. So, following that logic, owners of “elderly” homes should be better targets for selling home improvement products and upgrades, right? Not necessarily. Applying this age-old assumption blindly across all product categories can lead to lost opportunities for selling remodeling products and services to owners of newer homes.

Home Innovation’s 2019 Consumer Practices Reports provide insight into the relationship between home age and home improvement product purchases. It’s true, in a very general way, that older homes receive more care in the form of remodeling—particularly when it comes to interior painting, insulation, roofing, and windows. But it’s not true for all categories. The percentage of homes getting new Closet or Garage Storage Systems and Outdoor Living improvements (such as e.g., decks and patios), for example, spikes in the most recently constructed homes.

In order to better understand how a home’s age relates to specific remodeling activities, we analyzed our 2019 Consumer Practices Survey data to determine which categories of remodeling activity applied to various home vintages. The graph below shows some of what we found.

Downward sloping lines, like Interior Paint and Wallpaper, indicate a decline in likelihood of this specific activity for newer homes. For instance, about 22% of homes built before 1930 have some interior painting done, compared to about 14% of homes built in 2015 or later. Some home remodeling projects were shown to be most likely in “middle-aged” homes—these include Cabinets, Countertops, and Flooring. Plumbing Fixture replacements peak for homes built between about 1940 through 1980.

The steepness of a curve indicates the speed at which homeowners increase or decrease the rate of remodeling activities over the life of their homes. Likelihood of Interior Painting accelerates from brand new homes until they are about 10 to 15 years old, then increases only gradually after that. Appliance replacement peaks at about the 10- to 20-year mark then declines and remains fairly steady thereafter. Interestingly, HVAC System upgrades pick up speed earlier, in the 5- to 10-year range, and the curve flattens afterwards.

This is a fairly short period after construction considering HVAC System life is can be 15 to 20 years or more. This faster-than-anticipated replacement cycle for HVAC Systems may be due to homeowners seeking to increase energy efficiency and/or comfort in the home.

For Outdoor Living, momentum is at its peak within 3 years after move-in to a new home, levels off after that, and remains fairly steady over the life of the home. Siding and exterior finishes remains fairly flat across the life of a residential property—this does not necessarily indicate that newer homes are getting new siding as frequently as older homes; more likely it’s that owners of newer homes are purchasing siding for detached buildings that are added to the property, while older homes are more likely to get siding for the primary residence itself replaced. Also, siding replacement due to storm damage affects homes regardless of age.

The Consumer Practices Survey findings extend far beyond who does the remodeling—it also includes details on the amount and types of products and materials purchased; from which stores were they purchased; and the volumes purchased for home remodeling in every State, Metro Area, and County in the United States. Analysis like this can help home remodelers and manufacturers of materials suppling the home remodeling industry sharpen their marketing and messaging and ensure they don’t overlook key market opportunities by making costly assumptions.

Home Innovation has just completed the new 2019 Consumer Practices Reports for the following product categories:

Appliances | Cabinets for Kitchen & Bath | Countertops

Deck & Porch Railings | Exterior Doors | Faucets

Fencing & Landscape Walls | Finished Flooring | Garage Doors

Home Mechanical Ventilation | Home Standby Generators

House Wrap & Foam under Siding | Insulation | Interior Doors

Interior Finish Materials | Outdoor Structures - Decks, Patios & Porches

Patio Doors | Plumbing Fixtures | Plumbing Piping | Roofing

Roofing Underlayment | Sheathing - Floor, Roof & Wall

Siding & Exterior Cladding | Soffit, Fascia & Exterior Trim

Storage Systems for Closet & Garage

Structural Systems - Floor, Roof & Wall | Windows

For a sample report, contact us.

Back to Top