July 14, 2017

Market Education Key to Market Domination

Lesson from the floor joist industry: When you take the lead in educating the market, your brand can become the market leader.

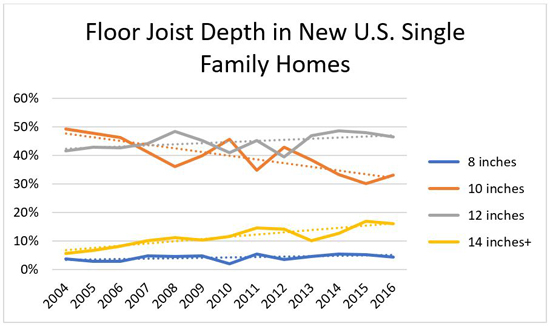

There’s a mystery surrounding wood floor joists in new homes that keeps getting deeper—literally! In 2004, more than half of wood floor joists in new homes were 10 inches or less deep. Now, more than 60 percent are 12 inches or deeper.

Source: Home Innovation Research Labs, Inc.; Annual Builder Practices Reports

So why are wood floor joists getting deeper? On first examination of historic data, I was puzzled but quickly came up with a handful of plausible explanations:

- Increased Popularity of Tile & Stone Floors: Tile and natural stone floor finishes have grown from about 18 to 22 percent of new home floor area in the past decade. Deeper joists make for stiffer floors, which are prized for minimizing floor cracking, and being less prone to flexing and vibrating. While growth in tile and stone flooring shares likely played a role in the floor joist trend, it can’t be the complete reason. Joist depth is only one factor that contributes to floor stiffness. Others that play an equally important role include subfloor thickness and span between joists (16", 19.2", or 24"). Since 2004, however, there has been little change in subflooring thickness (mostly ¾") or joist spacing (mostly 16").

- Larger Homes: Notwithstanding the small and tiny house trends, single-family detached homes are bigger now than a decade ago—averaging from 2,300 SF in 2004 to about 2,600 SF in 2016. Logically, bigger homes mean larger home footprints, which mean longer floor spans and deeper joists. While the logic sounds good, it is still not sufficient change to account for the entirety of the floor joist deepening.

- 2-Story vs. 1-Story: Another possibility I examined is the share of two-story vs. one-story homes built. Given comparable square footage, one-story homes have larger footprints than two-story homes. Hence, single-story homes favor longer floor spans. However, the trend in new home stories does not coincide with the trend in floor joist depth. The share of homes with 2-stories or more grew from 58 percent in 2005 to 65 percent in 2012, and have fallen to 60 percent since that peak.

- Growing Popularity of I-Joists: Since 2004, wood I-joists (most are 12" deep) have grown in popularity—from 43 to 48 percent of all structural floors. The dimensional lumber (2x10s are most popular) share of the floor joist market has declined from 41 to 36 percent. Naturally, this shift from lumber to I-joists favors deeper joists. However, a delve into the data proves that in both I-joist and lumber floor joist categories, builders opted strongly for deeper joists. For example, 2x10s fell from 80 to 60 percent of the lumber floor market, while 2x12s grew from 10 to 30 percent.

Most Likely Trend Driver?

After weighing the relevant factors, and watching the evolution of the market over the past few decades, I believe the primary reason behind the deeper floor joist mystery is an increasingly sophisticated market. Builders know much better now how a floor should feel when you walk across it, and they also have access to the design tools they need to spec a better floor. Code-minimum structural floors are now considered by many to be a sign of poorly planned housing.

Weyerhaeuser gets the primary credit for this trend brought about by market education. The company’s extensive research in floor performance has broken new ground, and its concerted effort to educate and provide builders with decision tools for optimizing floor performance (e.g., TJ-Pro® Rating system) has brought the market with it in sophistication. I believe this is the key reason Weyerhaeuser’s Trus Joist TJI still dominates the wood I-joist market.

But this isn’t unique to just floor joists. In parallel, DuPont maintains a dominant market position with its Tyvek products because of its extensive research and market education. More than half of all housewrap on newly constructed homes now carries the Tyvek brand name.

See a pattern here? The story behind this major transformation is a lesson to manufacturers: by taking the lead in educating the market, you benefit by maximizing market share, improve the overall health of your market, and provide consumers with better performing homes. Companies wishing to play a bigger role in leading the market should heed the examples of these two companies. What are your best opportunities to educate your market? Let us help you find the sweet spot – get in touch today.

Back to Top