July 9, 2021

A (How It’s) Heated Debate: Gas or Electric? 2021 Update

The debate has continued for years. Gas or Electric? For a new home, the answer often centers on the tradeoffs between short-term affordability vs. long-term operating cost.

With the new home industry undergoing a period of stress and rapid change, seemingly in favor of the “all electric” home, natural gas and propane are still maintaining the lead, and even growing in some sectors, as the most popular choice for space heating, cooking, and water heating fuels. But this trend is not static.

Traditionally, the argument has been that electric appliances, space heating, water heating, and clothes dryers were the simplest and lowest cost option for new homes. On the flip side, gas heating and appliances have been considered the option with lowest operating costs, quicker heat, and higher capacity heating. The choice of heating and cooking fuels is further influenced by individual buyer preferences, their budget, and local utility prices for gas, propane, and electricity.

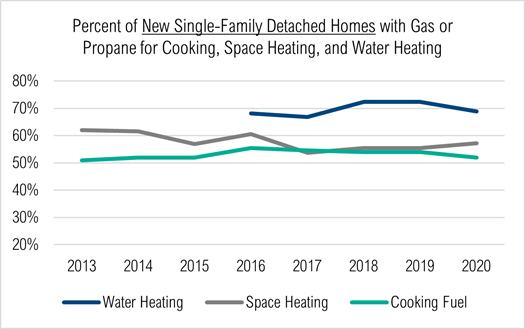

Home Innovation’s Annual Builder Practices Survey has been tracking shares of new homes and energy choices by builders and home buyers — including natural gas, propane, electric, fuel oil, solar, and wood/pellet categories – for decades. Since 2013, the use of gas for space heating has declined slightly in single-family detached homes (from 62% to 57%), despite historically low natural gas prices. On the other hand, gas has grown very slightly in water heating (68% to 69%) and cooking fuel (51% to 52%) between 2013 and 2020.

Source: Home Innovation’s Annual Builder Practices Survey, 2021

What’s driving the (relative lack of) change? There are numerous factors at play in the industry today — some favoring gas heating and cooking, and some favoring electric. On balance, these have tended to cancel each other out, resulting in the fairly flat curve you see in the graph above for single-family homes. For example, factors favoring electric include the shift of new single-family home construction to outlying areas as land availability remains scant in densely populated areas — areas that are less likely to be serviced by gas utilities. Other pluses for electric are rapidly appreciating home values and buyer demographics are favoring younger buyers; both of which put pressure on affordability and encourage builders and buyers to choose electric as it typically has the lower initial cost.

Factors favoring the use of gas and propane include increasing popularity of space-saving tankless water heaters that are typically fueled with natural gas or propane. Also, gas is getting a boost as a reliable source of fuel in the wake of recent utility grid failures, rolling blackouts, and brownouts in many areas.

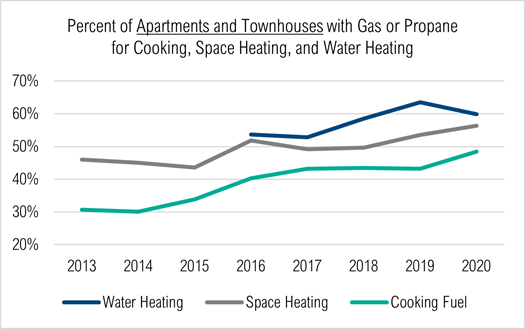

The question of gas vs. electric utilities for multifamily housing, on the other hand, has starkly different answers than in detached houses, based on Home Innovation’s Annual Builder Practices Survey. In all categories, there have been substantial increases in the share of multifamily builders and developers choosing gas or propane, as shown in the graph below.

Source: Home Innovation’s Annual Builder Practices Survey, 2021

Since 2016 for multifamily, gas and propane for water heating has grown from 54% to 60%; space heating from 52% to 56%; and cooking fuel most rapidly, from 40% to 48%. One likely reason for this notable increase is the growing share of new multifamily projects in urban and densely populated suburban areas and in regions serviced by gas utilities.

Looking ahead, there are some key drivers we’ll be tracking that could further change the dynamic of the new home fuel choice.

- The rise of highly energy-efficient building envelopes has lowered the heating requirement in new homes – this may favor lower-capacity heating alternatives.

- Technology advances in heat pump efficiency could favor electric heat pumps, while micro combined heat and power (CHP) systems could favor gas.

- Zero net energy home popularity could result in a boost for either gas or electric.

- The growth in popularity of telecommuting as a result of COVID-19 may keep development in less densely populated areas.

- Regulatory pressures are always an open question but can have major impacts — e.g., limiting the expansion of new pipeline projects and low-cost natural gas extraction methods, or expanding or eliminating incentives for rooftop solar electric panels on new homes.

- Demographics will also exert an influence — while entry-level homes are now seeing a boost in demand, we expect mid-range and high-end home markets to expand as the Millennial generation moves through its lifecycle.

As in life, there is one surely one thing is certain about the housing industry — there will be change. Keeping track of it helps keep companies ahead of the curve and better able to shape the future. If you’d like to learn more about tracking the progress of the market for your home building and remodeling products and services, contact us to see how Annual Builder and Consumer Practices data can help.

Back to Top