May 17, 2019

Home Size Declines with Robust Return of Starter Home Market

Home Innovation’s recent 2019 Builder Practices Survey of 1,500+ U.S. home builders confirms what the U.S. Census has been reporting in recent months—the average new home size is declining. For the second time in a decade, the average home size paused its upward climb for at least a couple years of descent.

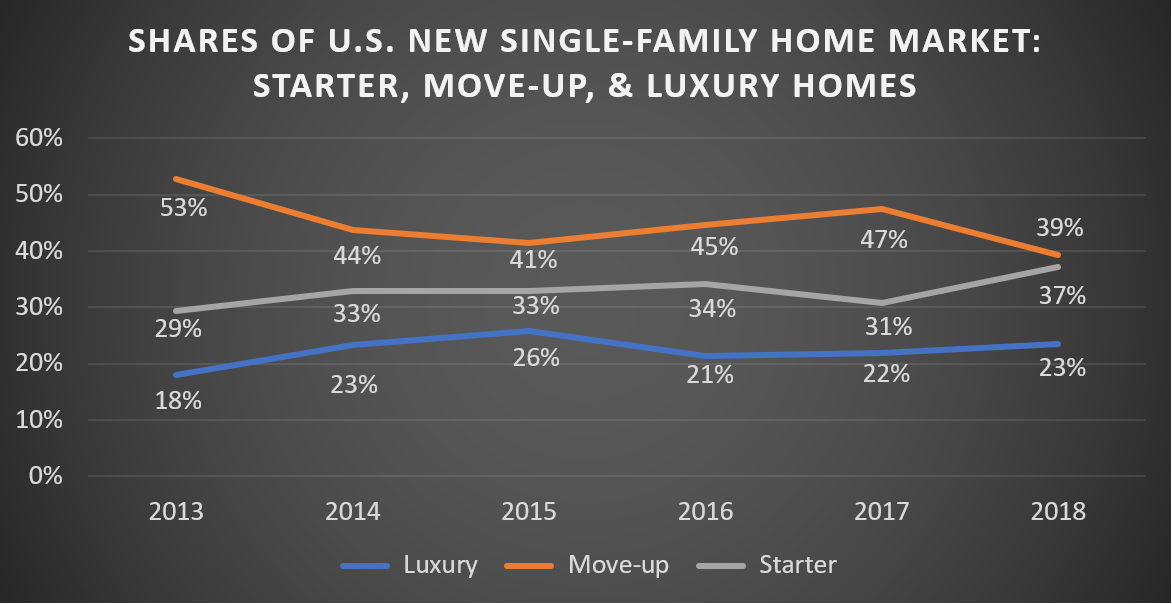

Driven primarily by demographics—i.e., the increasing share of younger people in the purchase of new homes—this decline in housing size results from a change in the housing mix. More Starter homes are being constructed and purchased than Move-up homes in recent years.

Source: Home Innovation's Annual Builder Practices Survey.

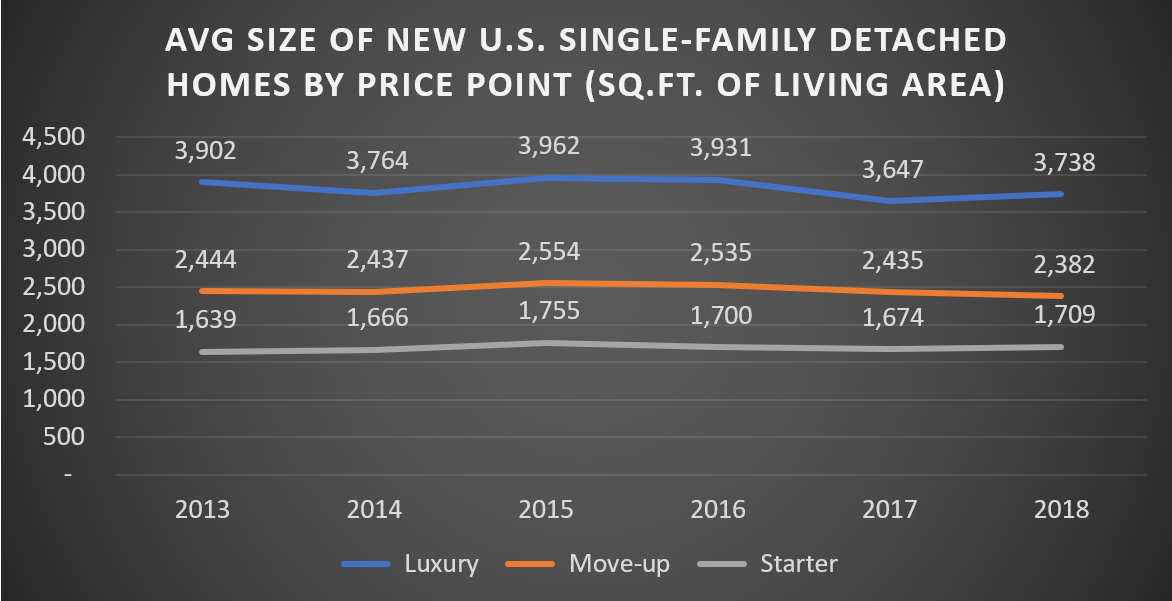

Adding to this, the average Starter, Move-up, and Luxury home sizes are also in decline but only incrementally and only in some price-point categories. The graph below shows a mild decline in average size over the past 5 years in builder-defined Luxury and Move-up homes and a modest increase in the average size of a Starter home.

Source: Home Innovation's Annual Builder Practices Survey.

The overall impact of home size decline is having some unexpected effects. In general, we would expect the housing market movement to favor lower-priced home features and materials across the board. This is confirmed in some of the following 2019 study results:

- Shares of Single-story homes are up

- Shares of Crawlspace and Slab foundations are up

- Shares of homes with gas appliances and heating equipment are down

- Total number of rooms and closets down slightly

- Treated wood decking and exterior hand railing gained at the expense of cedar and redwood

- Radiant floor heating took a hit, particularly whole-house hydronic

- Vinyl siding and windows lost some ground, while fiber cement siding and trim gained

- Brick gained some share

However, we also saw some new home characteristics and materials favor traditionally higher-end materials as well:

- Two-car garages grew in popularity over one-car, and fewer homes did not have a garage

- Average number of patio doors per home is up, but sliding doors gained over hinged

- Composite decking did not decline—it gained very slightly

- Interior light fixtures rose from 38 to 39 per home with most growth coming in the downlighting category

- More homes had ceiling fans

- Architectural asphalt roof shingles gained over 3-tab shingles

- Flooring continues to go more upscale—particularly hardwood and ceramic tile

This is just a glimpse at the types of products and categories we track and the kind of market trends we see in what we track. Our full list of product categories for our Builder Practices Survey includes:

Appliances | Bathroom Accessories | Beams & Headers | Cabinets

Countertops | Deck & Porch Railings | Ducts | Exterior Doors | Faucets

Fencing & Landscape Walls | Fire Sprinklers | Finish Flooring | Foundations

Garage Doors | Home Electronics | Home Mechanical Ventilation

Standby Generators | House Wrap & Radiant Barriers | HVAC Systems

Infrastructure | Insulation | Interior Doors | Interior Finish Materials | Lighting

Outdoor Structures | Patio Doors | Plumbing Fixtures | Plumbing Piping

Roofing | Roofing Underlayment | Sheathing - Floor, Roof, Wall

Siding & Exterior Finish | Soffit, Fascia, & Exterior Trim

Structural Systems - Floor, Roof, Wall | Swimming Pools | Underlayment

Vapor Retarders in Walls & Ceilings | Windows

Why Trust Home Innovation’s Builder Practices Reports?

Our reports are far more than just summary tabulations of a national survey of home builders. We employ a robust market demand modeling methodology that compiles volume and type of products and materials purchased. We report market demand for single and multi-family properties separately.

We’re also providing more options than ever in data format. The large survey sample size allows data subscribers to get a very granular look into county, metro area, state, and regional markets for new home products purchases. This year, the Builder Practices Reports will be available in both tabular and database formats that give you more analysis options, including analysis via business analytics and mapping software.

For more information, contact Ed Hudson, Director of Market Research, via our online form or by calling 301.430.6305.

Back to Top