June 19, 2019

Insulation Choices Revealed in New Study

Home Innovation’s 2019 Annual Builder Practices Survey of home builders had more than 1,600 participants this year, completing the detailed questionnaire on the homes they built in 2018. This study helps us track – and predict – trends in the popularity of home styles, features and materials used.

One category, thermal insulation, is not as predictable as some other categories. The adoption of more stringent energy codes is widening, homebuyer demographics are beginning to favor smaller homes (and smaller budgets for energy bills), and labor and material price increases are putting pressures on home builders to seek lower-cost alternatives. In the current industry environment, higher performing insulation yet more budget-friendly is the ideal recipe for success. These factors seem to be tugging the market in different directions, so getting an early read on the direction of new insulation market demand is key to staying one step ahead.

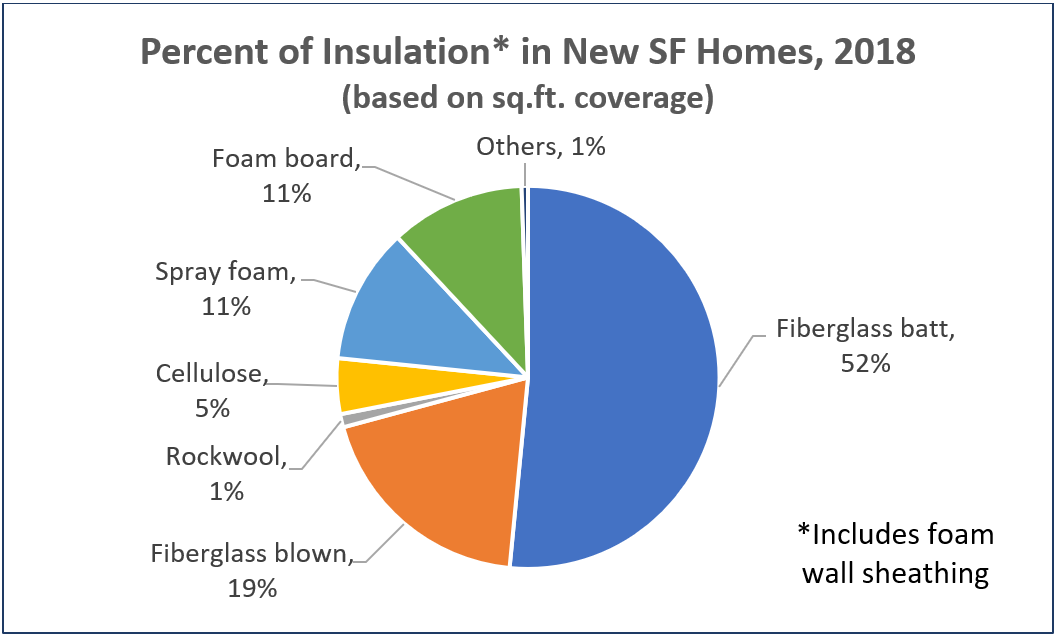

Based on the Builder Practices Survey results, Fiberglass insulation remains solidly the most popular insulation material in new homes. Considering all areas of new single-family homes – floors, walls, and roofs – Fiberglass Batt insulation now comprises about 52 percent and Blown Fiberglass represents 19 percent of installations. Shares of Batt and Blown Fiberglass have been fairly static over the past few years as well.

Source: 2019 Annual Builder Practices Survey, Home Innovation Research Labs

Foam Board and Spray Foam represent nearly a quarter of the insulation usage in new single-family homes. Foam Board share is inching ahead, and Spray Foam saw a two percentage point uptick in 2018 over the previous year. On the other hand, Cellulose has seen a substantial decline in market share in new homes over the past few years.

While the national picture might seem a little static, market direction changes aren’t happening evenly across-the-board. Spray foam has seen its biggest boost in attics with cathedral ceilings – now at 22% of this market. Fiberglass batts are trending up as a wall cavity insulation at the expense of blown fiber systems, but batts are trending slightly downward in ceilings. The opposite is true for blown fiberglass – down in walls but up in ceilings. Cellulose usage is down in all areas of new single-family homes- floors, walls and roof – and, by both functions – thermal and acoustical insulation. On balance, while foam board is growing slightly, it’s not a common wall, floor and roof cavity insulation. Its growth has been as an exterior wall sheathing material – particularly installed as a second layer over OSB or Plywood.

Insulation Decision Dynamics and the Future

The performance vs. value tradeoff in the decision to specify insulation materials is often discussed among home builders. Some would use a full-cavity fill of foam insulation if the cost were lower. Some believe fiberglass is the best bang-for-the-buck, but if they’re looking for higher energy performance, they will put their money into other areas of their homes – like more energy efficient windows and HVAC systems.

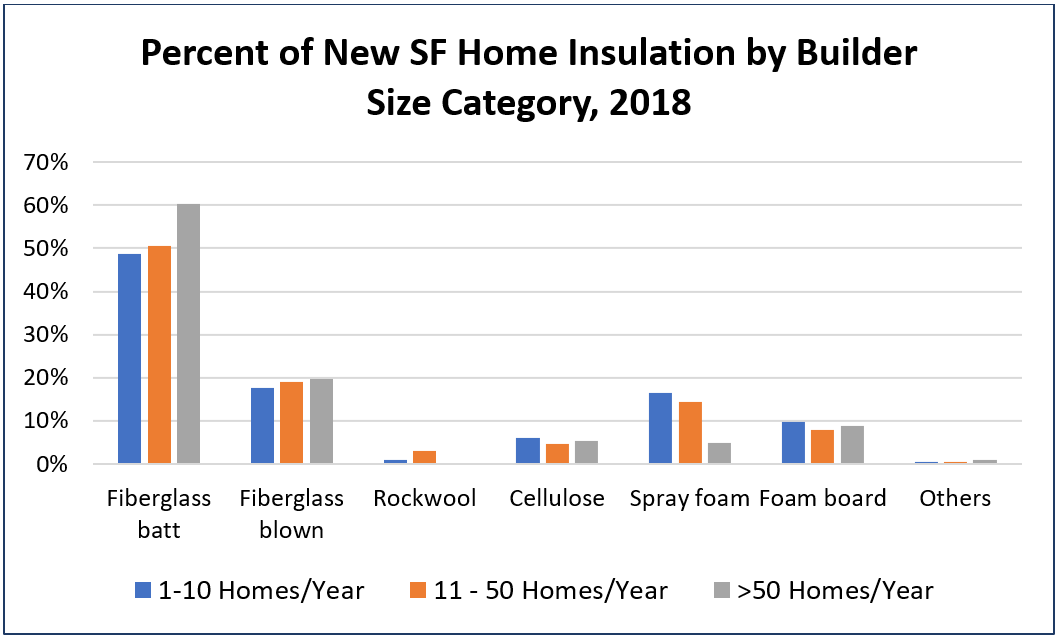

The 2019 Builder Practices data reveals that builder insulation preference differs by geographic area, price-point of home, and size of builder. Much of predicting the future of the insulation market rests on tracking housing activity by geographic area and home buyer demographics. For example, Fiberglass batt has its deepest market penetration in Pacific states and lowest in West South Central states. Smaller builders (10 or fewer starts-per-year) are three times as likely to use spray foam than larger builders (more than 50 starts-per-year). The reverse is true for fiberglass batts – larger builders are more likely to use them.

Source: 2019 Annual Builder Practices Survey, Home Innovation Research Labs

Difference in insulation usage was less stark between Starter, Move-up, and Luxury homes than comparing by builder size. Nonetheless, Spray Foam was about twice as likely to be used in Luxury homes than in Starter or Move-up homes. Also, Fiberglass Batts and Blown are somewhat more likely to be put in Starter homes than in Luxury homes.

Home Innovation Research Labs is Tracking Insulation Usage in Remodeling as Well

Each year, Home Innovation conducts a survey of about 100,000 U.S. households on their repair and remodeling activities. Thousands of households report the details of their insulation and re-insulation purchases to us for their existing homes. This information is summarized in the Consumer Practices report for Insulation. For more than 20 years, the Builder and Consumer Practices Reports have been published annually for Insulation and 45 other building product categories. They are available with geographic details for each 50 states and for all U.S. counties and metro areas. Contact us for more information on how you can gain access to this vast resource for building product market data.

Back to Top